You may have heard that in California, employers can be fined up to $4,000 per employee for not handing out pay stubs.

If you live in a different state or just started a new job, that may have you wondering. Does your employer need to hand out employment pay stubs?

The law in this area is a bit mixed. This guide will answer your questions and help you determine what you can do if your employer isn’t giving you pay stubs.

Federal Law on Employment Pay Stubs

The first question most people have is whether there’s a federal pay stub law. That is, does federal law require your employer to hand out pay stubs?

Unfortunately, the answer is no. There’s nothing in federal law that says employers have to hand out pay stub records.

There is a rule in the Fair Labor Standards Act that requires employers to keep good records. There’s considerable debate about whether employees have a right to request a pay stub because of this law.

Some experts hold that you can request to see the employer’s records. Others say federal record-keeping requirements don’t give employees the right to see records.

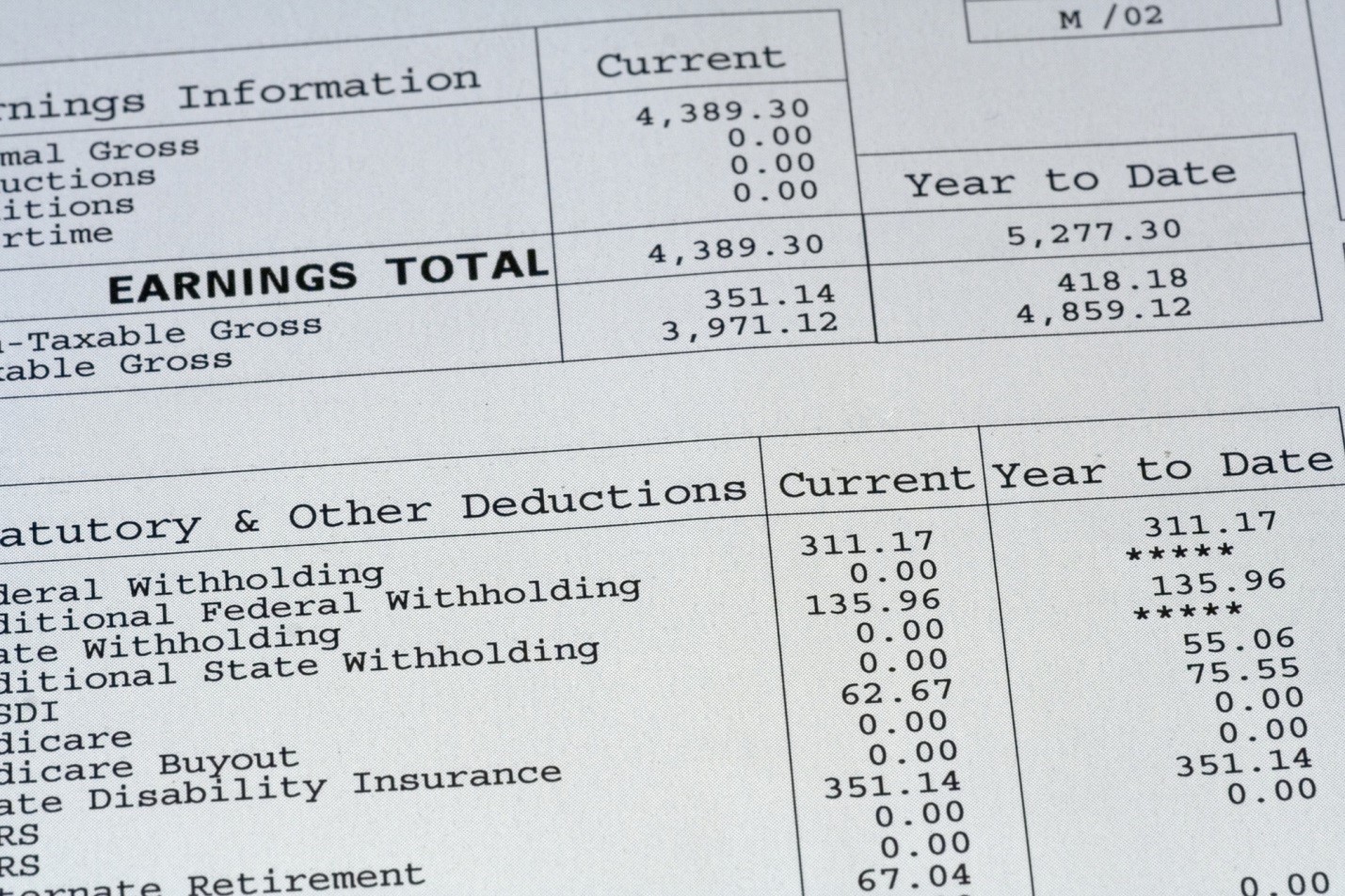

Employers must include much of the information that goes on a pay stub in their records. They must keep track of wages and overtime, as well as other key details.

State Law May Require Pay Stubs

Federal law doesn’t ask employers to do much more than keep good records. State law may require employers to hand out pay stubs.

In fact, the majority of states in the US have a law about employment pay stubs.

online pharmacy purchase lexapro online best drugstore for you

In 41 states, your employer must give you a pay stub.

online pharmacy purchase cytotec online best drugstore for you

There are two major camps when it comes to pay stub laws. Some states are known as “access” states, and their requirements are somewhat different than “print” states.

Access States

The majority of states have laws that say employers must give employees access to pay stubs. These states include:

- Alaska

- Maryland

- New Jersey

- Oklahoma

- South Carolina

- Utah

All told, 26 states have access laws. What this means is that your employer must provide access to your pay stub records.

Access can be granted in either an electronic format or a printed format. So long as the employer gives you a pay stub, they’re in line with the law.

Print States

Things are a little different in states with print laws. There are 11 states with so-called print access laws. What this means is that employers in these states must provide employees with a printed copy of their pay stub.

An employer can also offer electronic access, but the pay stub cannot be issued as an electronic-only document.

States that require print access include:

- California

- Maine

- North Carolina

- Texas

In some of these states, like California, not issuing a pay stub can carry some hefty fines.

Opting in and Opting Out

There are a handful of states that have opt-out rules about electronic pay stubs. These are:

- Delaware

- Minnesota

- Oregon

In these three states, employees can opt out of electronic pay stub programs adopted by employers. If an employee opts out, they must receive a paper pay stub.

Only one state has an opt-in program for electronic pay stubs. Hawai’i requires employers to provide paper pay stubs unless employees choose to enroll in an electronic pay stub program.

No Pay Stub Rules in Some States

There are a total of nine states that have no laws on the books about pay stubs. These are:

- Alabama

- Arkansas

- Florida

- Georgia

- Louisiana

- Mississippi

- Ohio

- South Dakota

- Tennessee

Unlike the other 41 states, employers in these states are under no obligation to provide a pay stub. That means if you work in one of these states, an employer not giving pay stubs is not an issue you can pursue.

That said, employers in these states are still required to keep good records under FLSA. An employer in Georgia, for example, may choose to create check stubs as part of their record-keeping for FLSA.

What Can You do?

If an employer not giving pay stubs is a concern for you, the first thing to do is check the state law. In most states, not giving pay stubs carries a penalty.

The penalty for not giving pay stubs varies between states. As we noted, California allows an employer to be penalized up to $4,000 per employee. The penalty is usually levied per missed pay stub, up to the maximum.

New York, an access state, follows a similar set of rules. The penalties are different, with a higher maximum per employee.

It’s important to note that California requires printed pay stubs, while New York does not. If your employer offers you access to your pay stub by email or through an employee website, they could be penalized in California.

online pharmacy purchase premarin online best drugstore for you

They wouldn’t be breaking the law in New York.

It’s Easy to Make Pay Stubs

Today, most employers are aware of their obligations to keep good records. With new technology, like software and online pay stub makers, it’s easier than ever for them to create pay stubs.

Since they need to keep records and making pay stubs is so simple, many employers will choose to hand out stubs to their employees.

If your employer isn’t handing out pay stubs and you live in a state where it’s not required, there may not be much you can legally do. You can always suggest to them that an easy-to-use pay stub maker could help them with their record-keeping.

After all, better financial records benefit the business as a whole.

Technology Powers Business Forward

By now, you should have a good idea of whether your employer needs to give you employment pay stubs. If you’re not receiving your pay stubs, it could be time to check in with either your employer or legal counsel.

Technology can make most aspects of running a business easier. Discover new trends and technologies that can help run a business or build your next career move.

Read More: Top Main Challenges That All Businesses Face