The trading world has a variety of Forex indicators; that’s why it can be difficult for traders to identify when and how to use the Forex indicator successfully. Having a complete command of Forex indicators can save the traders from the trouble of blind reliance on the Forex indicators, which has ruined the capital of many traders.

This article will walk you through the entire explanation of Forex indicators, how they work, and where you can find the best Forex indicators that are tested and reviewed.

Before getting started, let’s first learn the basics of Forex indicators.

What Are Forex Indicators?

Forex indicators work on the principle of mathematical calculations allowing the user to analyze the signals and determine the most suitable currency pair.

The math behind the indicators is not simple every time. It can be as complex as calculating the standard deviation or implementing linear analysis. However, it can be as simple as comparing the closing price of two periods.

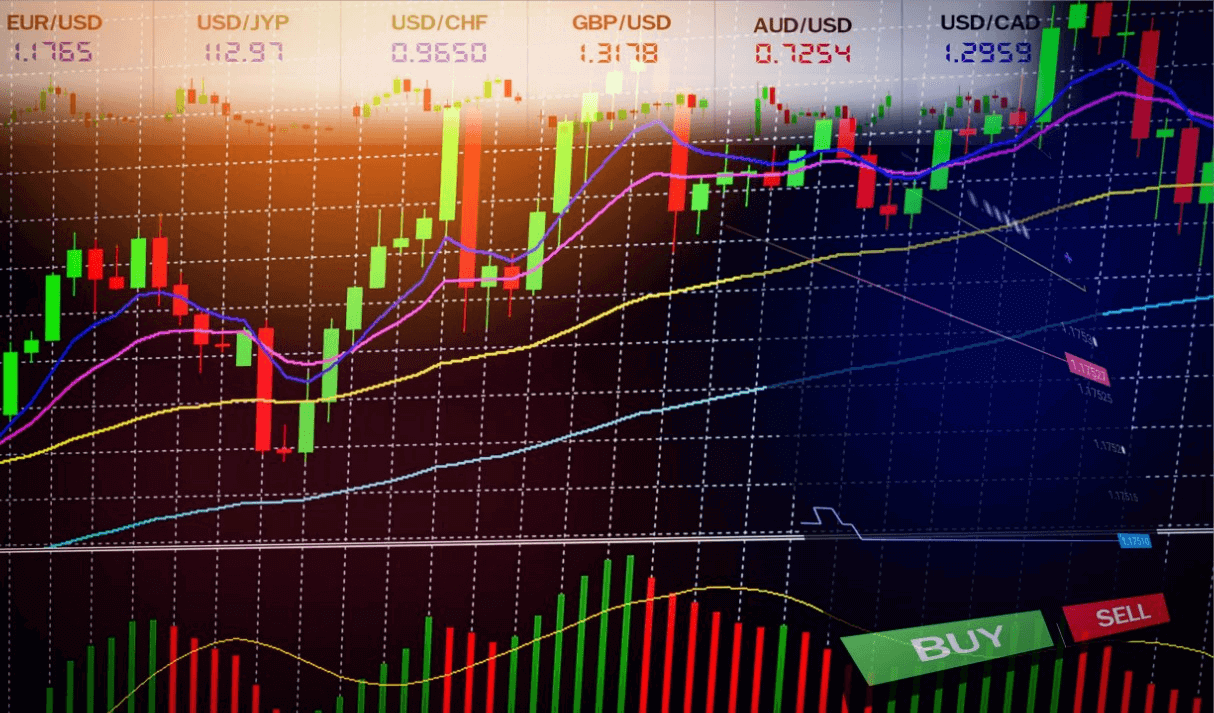

It helps you determine the movement of currency through multiple factors such as open interest, exchange rate, and volume. They showcase data in the form of charts and graphs.

So, can a trader get these indicators for free? Or does he have to pay the price for it? Let’s find out in the infra paragraphs.

Are There Free Forex Indicators?

Yes, free Forex indicators are available for testing and trial. They also allow the users to examine the future market trends and use the data to predict future possibilities. Here’s one example of a great free Forex indicator:

Most beginners search for free Forex indicators before using the paid version to check the authenticity of the signals.

The best way to clear the scams and troubles of free Forex indicator providers is to ALWAYS try it on your demo account.

Let’s take a look at how these indicators work.

How Do Forex Indicators Work?

Forex indicators read the signals and look for past patterns that are more likely to be repeated. They focus on the style of market behavior rather than targeting a random series of events.

Forex indicators read the signals and look for past patterns that are more likely to be repeated. They focus on the style of market behavior rather than targeting a random series of events.

For example, the political instability in your country can affect the movements of currency; it may fall out. Forex indicators will save this information to predict similar future market behavior.

The in-built feature in Forex indicators generates a beep to alert the user about the right timing to enter or exit position.

Now that you already have a basic knowledge of the Forex indicator let’s dig a little deeper and find out the characteristics of a good Forex indicator.

Top Characteristics of a Good Forex Indicator

Are you all confused about how to pick the Forex indicator that works well for you?

Virtual High Five from traders like you!

You are not alone. Many novice traders struggle to get their hands on reliable indicators.

The simple rule of thumb for electing the Forex indicator is its simplicity and ease of understanding. Using complex and mind-boggling indicators will do you no good.

However, the perception of “easy to understand” varies from person to person, depending upon their knowledge of Forex indicators.

It is a waste of time to use complicated indicators. You will not be able to obtain benefits from these kinds of indicators. Technically the easy-to-understand indicators are more effective and convenient.

Should You Be Using Forex Indicators?

You may be thinking if Forex indicators are for you or not. Whether you’re a beginner or a professional trader, it’s a way to simplify complex data.

You may be thinking if Forex indicators are for you or not. Whether you’re a beginner or a professional trader, it’s a way to simplify complex data.

It is a daily routine of traders to use the Forex indicators to optimize the decision-making process. The more you are aware of the market and the workflow of Forex indicators: it will help you to make better and more informed decisions.

Do you wonder why traders tend to use Forex indicators?

Let us look into some of the benefits of using Forex indicators.

Top 2 Benefits of Using Forex Indicators

-

Offer Technical Analysis

Technical analysis is a study of analyzing the behavioral patterns of historical data.

A fully developed Forex indicator will offer you the technical analysis of the current market based on the number of players and long-time national-level trends. It means that the Forex indicator depends upon the timeframe and evolution in the market trends.

The 2nd benefit of using a forex indicator is:

-

Help in Reducing Risks

Forex signals help minimize the risk since Forex indicators keep an eye on the latest news and events. They also store the previous repeated information to predict the future, making them less vulnerable to false decisions.

Are Forex Indicators Effective and Profitable?

Another frequently asked question is whether Forex indicators are effective. Although they are not a guarantee card for successful trading, they help the user make strategic investments and decisions to align with the market movements. If the Forex indicator matches your strategy, it can do a lot of magic for you.

Another frequently asked question is whether Forex indicators are effective. Although they are not a guarantee card for successful trading, they help the user make strategic investments and decisions to align with the market movements. If the Forex indicator matches your strategy, it can do a lot of magic for you.

The Forex indicator is similar to the GPS installed in your cars, guiding you about the directions and routes to reach the destination but the driving part is on your shoulders.

For profitable trading, keep the technical and fundamental factors at your fingertips. Moreover, observe the latest market trends and try to get a good grasp on Forex indicators.

What’s the Best Forex Indicator for You?

Every trader desires to use the best Forex indicator to ace in the trading world. No matter how much we search for the best Forex indicator, finding a tested and reviewed version of the indicator is not easy.

There are many indicators in the market, one popular over another. Still, popularity can not make them beneficial for you. It’s more about what type of trading style you want to engage in.

After obtaining the data from the Forex indicator, don’t act immediately but try to study the data summary and acknowledge that it matches your objective. The best indicator for your trading career is the one that matches perfectly with your objective and helps you thrive in the game of trading.

Additionally, picking up the best indicator is only possible if you pass by a broker willing to provide all the tools and facilities you need.

Conclusion

As you may expect, Forex indicators might work for you if you use them correctly. And this can only be achieved by understanding the principles and foundational concepts of Forex indicators and the trading market.

The trading style or technique you choose might be full of risks. Therefore, before relying on any Forex indicator, one should be aware of its risk.

If you’re just starting out, look for the most effective and simple strategies for identifying trades and stick to them.

Happy trading!