In the past several years, we’ve seen an insane amount of growth in the online business. Even the old school business owners are making the best out of their online businesses. consumers can buy anything online that they can possibly think of. So, more and more entrepreneurs are trying to grow their businesses online. But starting an online business is not as simple as it sounds. Whether it’s a startup, small business, or highly reputed e-commerce giants like Amazon, every online business is required to follow the corporate and copyright rules and regulations. This also includes laws imposed by the country for consumer protection. If not followed, your e-commerce website is likely to face some legal ramifications.

Know These Legal Requirements Before Starting an Online Business

Your online business is required to follow some of the local and corporate state laws regarding tax and documentation as well as the international laws to operate globally. Like maintaining data privacy by providing safe electronic payment methods. If you are new to Delaware and want to create Delaware LLC, then the first and the most important is to create a Delaware entity search. Some further details on these legal requirements are listed below.

1. Taxes

Following the tax regulations imposed by your state is the most important aspect of any online business. There are a few types of taxes that US-based online businesses are bound to charge. Let us give you an insight into the types of taxes imposed on an online business in the US.

- Sales tax: In the US, sales taxes vary from state to state and also different localities within the state. Any mistakes in overcharging taxes can lead to straight lawsuits against your e-commerce site.

online pharmacy purchase zithromax online generic

Moreover, If you fail to properly calculate tax, it will end up charging less tax than necessary. This will put a hole in your profit. So you must all the important information about sales taxes in your business registered state.

- Import duties and taxes: If your business involves importing products from out-country suppliers and if it exceeds the threshold limit then those products will be subjected to customs duties. If international ship ins are a regular thing for your business then it may also involve other taxes and tariffs. If these import duties are not calculated in advance then it will be dangerous for your business and any unpaid import duties will lead to legal ramifications

- Eco taxes: Many states have started to charge Eco taxes which is taxation on products and processes that are harmful to the environment. For example, some states are introducing extra charges and regulations for the use of plastic containers. Also, some states in the US have proposals on ecotax that would involve taxes on individual products that have single-use plastic packaging. So, you should also make sure that your online business operates in a way that has the least harm to mother nature. Any unpaid taxes due to the lack of knowledge about the Eco Taxes in your state will lead to legal action against your business resulting in business loss.

2. Documentation

The documentation involves terms and conditions, privacy policy, rules and regulations, and so on. Every e-commerce business has these mentioned clearly on its website. These are very important to ensure your business’s safety. Also, if you are an authorized seller on a website or your business involves distributing products across sellers then it is very important to properly read and sign seller’s agreements. If taken lightly, any mistake or miscommunication in your signed seller’s agreement can cause legal problems.

3. Business Insurance

Though business insurance is not mandatory for online businesses, if you feel that it’s necessary, proper knowledge about the available options is necessary. You can get business insurance for product liability, professional liability, general liability, commercial liability, and so on.

If you are a registered business entity such as an LLC then your business is likely to give you the best protection with minimal rules and regulations in place. However, there are always chances of missing out on some points when it comes to LLC as it might change depending upon where your LLC was formed and in which states your online business operates. So it is always a good idea to take help from legal professionals.

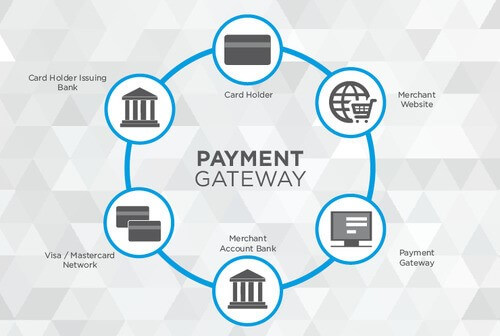

4. Payment Gateways

An understandable and secure payment gateway is highly necessary for the safe translation of payments from your customers to your business. The most necessary thing here is security. Any data breach of your customer’s number and bank details can lead to major frauds which will be named on your business. This might not only lead to legal lawsuits from customers but will also damage your brand reputation. You can also include payment awareness quotes on your e-commerce site like,

“The only available methods for the payment are Credit/debit cards, Net banking, COD, or Paypal. Any of our employees will not call you regarding cash transfers to a specific bank account. Be aware and do not be misguided by any fraud calls”

5. Age Restrictions

If a product is not suitable for children then it should be mentioned clearly on your e-commerce site. On top of that, every e-commerce website is required to comply with The COPPA (Children’s Online Privacy Act, 1998).

There is no other way through this law. This act involves a few laws but the most important one restricts any business from collecting personal information from children under 13 years old. Your e-commerce site must follow COPPA on any product designed for young audiences. Otherwise, your business could be fined up to $43280.

Conclusion

For every entrepreneur wishing to open an online business through an e-commerce store, It is highly essential to understand the online business laws and the consequences of breaking them. This will protect that your business against lawsuits and fines. Not only that it will also ensure your potential customer’s safety by protecting their valuable personal information. Before starting an e-commerce website, take your time to understand the state taxes, secure payment getaways, and age restriction laws in your state. This will surely futureproof your business against legal actions.

Read More: Trends for the Future of Online Businesses